Uncovering regional typologies in Europe in terms of interregional and intraregional direct investment flows

Published 2024-02-25

Keywords

- interregional and intraregional direct investment flows,

- O-D matrix,

- regional typologies,

- k-means clustering,

- Europe

How to Cite

Copyright (c) 2024 Maria Adamakou , Dimitris Kallioras , Panos Manetos , Lefteris Topaloglou

This work is licensed under a Creative Commons Attribution 4.0 International License.

Accepted 2024-02-25

Published 2024-02-25

Abstract

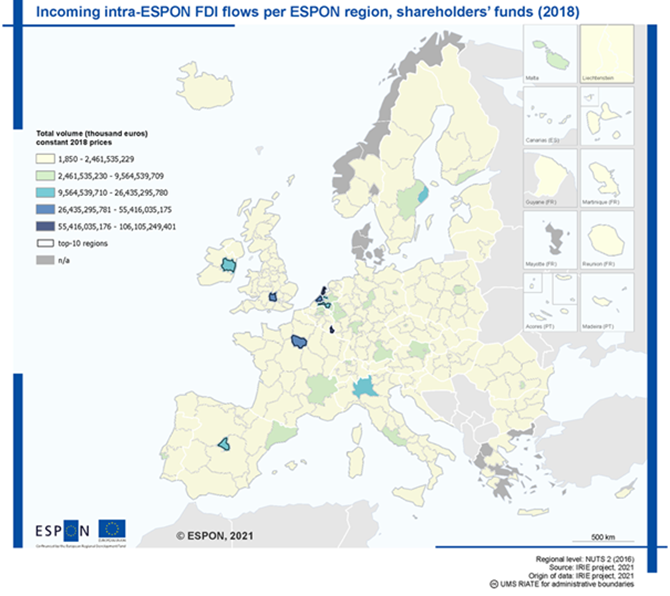

Information regarding direct investment flows across European space is scarce, and in most of the cases at the national level. Such a scarcity limits the capacity to undertake the required analyses and to derive the corresponding conclusions on the interrelations among European regions. This is especially so considering that Europe is gradually moving from a “space of States” to a “State of spaces” and from a “space of places’’ to a “space of flows’’. In a nutshell, the pure essence of the European economic integration process is the gradual “thinning” and “melting” of (the artificial) border impediments. Thus, as the process of European economic integration is in full swing, European territories have been experiencing a period of unprecedented change, being transformed into integral parts of the European economic space. The paper uncovers regional typologies in Europe in terms of interregional and intraregional (NUTS 2 level) direct investment flows in year 2018, the year prior to the eruption of the COVID19 pandemic. To this end, the paper compiles an O-D matrix for interregional and intraregional direct investment flows in Europe, constructs tailor-made clustering indicators and employs the k-means clustering technique.

Highlights:

- Compilation of an O-D matrix for interregional and intraregional direct investment flows in Europe

- Utilization of tailor-made clustering indicators

- Classification of European regions

Downloads

References

- Ascani A., Crescenzi R., Iammarino S. (2016). Economic institutions and the location strategies of European multinationals in their geographic neighborhood. Economic Geography, 92(4), pp.401-429. https://doi.org/10.1080/00130095.2016.1179570

- Bevan A., Estrin S., Meyer K. (2004). Foreign investment location and institutional development in transition economies. International Business Review, 13, pp.43-64. https://doi.org/10.1016/j.ibusrev.2003.05.005

- Breunig M. M., Kriegel H. P., Ng R. T., Sander J. (2000). LOF: Identifying density-based local outliers. ACM SIGMOD Record, 29(2), pp.93-104. https://doi.org/10.1145/335191.335388

- Brülhart M., Crozet M., Koenig P. (2004). Enlargement and EU periphery: The impact of changing market potential. World Economy, 27(6). pp.853-875. https://doi.org/10.1111/j.1467-9701.2004.00632.x

- Castells M. (2000). Space of flows, space of places: Materials for a theory of urbanism in the information age, In Le Gates R. T., Stout F. (Eds.). The city reader, 240-251, London, Routledge. https://doi.org/10.4324/9780429261732-30

- Crescenzi R., Pietrobelli C., Rabelloti R. (2014). Innovation drivers, value chains and the geography of multinational corporations in Europe. Jour-nal of Economic Geography, 14(6), pp.1053-1086. https://doi.org/10.1093/jeg/lbt018

- Davies D. L., Bouldin D. W. (1979). A cluster separation measure. IEEE Transactions on Pattern Analysis and Machine Intelligence. PAMI-1, 2, pp.224-227. https://doi.org/10.1109/TPAMI.1979.4766909

- Daube C., Stein E. (2007). The quality of institutions and foreign direct investment. Economics and Politics, 19(3), pp.317-344. https://doi.org/10.1111/j.1468-0343.2007.00318.x

- Devereux M. P., Griffith R., Simpson H. (2007). Firm location decisions, regional grants and agglomeration externalities. Journal of Public Econom-ics, 91(3), pp413-435. https://doi.org/10.1016/j.jpubeco.2006.12.002

- Djankov S., McLiesh C., Ramalho R. M. (2006). Regulation and growth. Economics Letters, 92(3), pp.395-401. https://doi.org/10.1016/j.econlet.2006.03.021

- EUROSTAT (2002). European Union Foreign Direct Investment Yearbook 2001. Luxemburg, Publications of the European Communities.

- Frenken K., van Oort F., Verburg T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41(5), pp.685-697. https://doi.org/10.1080/00343400601120296

- Fujita M. (1993). Monopolistic competition and urban systems. European Economic Review, 37, pp.308-315. https://doi.org/10.1016/0014-2921(93)90019-7

- Fujita M. & Thisse J.-F. (2002). Agglomeration and market interaction. CERP Discussion Paper, 3362.

- Gertler M. S. (2003). Tacit knowledge and the economic geography of context, or The undefinable tacitness of being (there). Journal of Economic Geography, 3(1), pp.75-99. https://doi.org/10.1093/jeg/3.1.75

- Gorg H., Greenaway D., Wey C. (2003). Is there a potential for increases in FDI for Central and Eastern Countries following EU accession? In Herrmann H., Lipsey R. (Eds.). FDI in the real and financial sector of industrial countries, 165-185, Berlin: Springer. https://doi.org/10.1007/978-3-540-24736-4_7

- Helpman E., Melitz M. J., Yeaple S. R. (2004). Exports versus FDI with heterogeneous firms. American Economic Review, 94(1), pp.301-316. https://doi.org/10.1257/000282804322970814

- Henderson V. (1986). Efficiency of resource usage and city size. Journal of Urban Economics, 19(1), pp.42-70. https://doi.org/10.1016/0094-1190(86)90030-6

- Henderson V. (1997). Externalities and industrial development. Journal of Urban Economics, 42, pp.449-470. https://doi.org/10.1006/juec.1997.2036

- IMF, OECD (2003). Foreign Direct Investment statistics: How countries measure FDI, 2001. Washington D.C., IMF.

- IMF (2009). Balance of Payments and International Investment Position manual (6th ed.). Washington D. C., IMF.

- Kahouli B., Maktouf S. (2015). The determinants of FDI and the impact of the economic crisis on the implementation of RTAs: A static and dy-namic gravity model. International Business Review, 24(3), pp.518-529. https://doi.org/10.1016/j.ibusrev.2014.10.009

- Kallioras D., Topaloglou L., Venieris S. (2009). Tracing the determinants of economic cross-border interaction in the European Union. Spatium, 21, pp.1-10. https://doi.org/10.2298/SPAT0921001K

- Karanika M., Kallioras D. (2018). EU spatiality under question - Territorial cooperation in danger. Territories, 1(1), pp.59-72. https://doi.org/10.5070/T21141511

- Kemeny T. (2011). Are international technology gaps growing or shrinking in the age of globalization?. Journal of Economic Geography, 11(1), pp.1-35. https://doi.org/10.1093/jeg/lbp062

- Krugman P. R. (1980). Scale economies, product differentiation and the pattern of trade. American Economic Review, 99, pp.950-959.

- Krugman P. R. (1991). Increasing returns and economic geography. Journal of Political Economy, 99, 183-199. https://doi.org/10.1086/261763

- Krugman P. R. (1993). First nature, second nature and metropolitan location. Journal of Regional Science, 33, pp.129-144. https://doi.org/10.1111/j.1467-9787.1993.tb00217.x

- Krugman P. R., Venables A. J. (1996). Integration, specialization and adjustment. European Economic Review, 40, pp.959-967. https://doi.org/10.1016/0014-2921(95)00104-2

- Lawless M. (2013). Do complicated tax systems prevent foreign direct investment? Economica, 80(317), pp.1-22. https://doi.org/10.1111/j.1468-0335.2012.00934.x

- Lipsey R. E. (2003). Foreign Direct Investments and the operations of multinational firms: Concepts, history, and data. In Choi E. K., Harrigan J. (Eds). Handbook of international trade, 285-319, Malden, Blackwell. https://doi.org/10.1002/9780470756461.ch10

- Manetos P., Kallioras D., Topaloglou L., Adamakou M. (2022). Uncovering regional typologies in Europe in terms of interregional remittances flows. Europa XXI, 43(3). https://doi.org/10.7163/Eu21.2022.43.3

- Mankiw N. G., Taylor M. P. (2017). Economics. Boston, Cengage Learning Publications.

- Markusen J. R., Venables A. J. (1998). Multinational firms and the new trade theory. Journal of International Economics, 46(2), 183-203. https://doi.org/10.1016/S0022-1996(97)00052-4

- Mathur A., Singh K. (2013). Foreign direct investment, corruption and democracy. Applied Economics, 45(8), pp.991-1002. https://doi.org/10.1080/00036846.2011.613786

- McCann P. (2008). Globalization and economic geography: The world is curved, not flat. Cambridge Journal of Regions, Economy and Society, 1(3), pp.351-370. https://doi.org/10.1093/cjres/rsn002

- Moomaw R. (1981). Productivity and city size. Quarterly Journal of Economics, 96, pp.675-688. https://doi.org/10.2307/1880747

- Naanwaad C., Diarrassouba M. (2016). Economic freedom, human capital, and foreign direct investment. Journal of Developing Areas, 50(1), pp.407-424. https://doi.org/10.1353/jda.2016.0011

- North D. C. (1990). Institutions, institutional change and economic performance. Cambridge, Cambridge University Press. https://doi.org/10.1017/CBO9780511808678

- OECD (2008). OECD benchmark definition of Foreign Direct Investment (4th ed). Paris, OECD.

- Ottaviano G. I. P., Puga P. (1998). Agglomeration in the global economy: A survey of the new economic geography. World Economy, 21(6), pp.707-731. https://doi.org/10.1111/1467-9701.00160

- Ottaviano G. I. P., Thisse J. F. (2004). Agglomeration and economic geography. In Henderson J. V., Nijkamp P., Mills E. S., Cheshire P. C., Thisse J.-F. (Eds). Handbook of regional and urban economics, 2563-2608, Amsterdam: Elsevier. https://doi.org/10.1016/S1574-0080(04)80015-4

- Ottaviano G. I. P., Thisse J. -F. (2001). On economic geography in economic theory: Increasing returns and pecuniary externalities. Journal of Economic Geography, 1, pp.153-179. https://doi.org/10.1093/jeg/1.2.153

- Petrakos G., Kallioras D., Anagnostou A. (2011). Regional convergence and growth in Europe: Understanding patterns and determinants. Euro-pean Urban and Regional Studies, 18(4), pp.375-391. https://doi.org/10.1177/0969776411407809

- Petrakos G., Rodriguez-Pose A., Rovolis A. (2005). Growth, integration and regional inequalities in Europe. Environment and Planning A, 37(10), pp.1837-1855. https://doi.org/10.1068/a37348

- Porter M. E. (1990). The competitive advantage of nations. Harvard Business Review, 90(2), pp.73-93. https://doi.org/10.1007/978-1-349-11336-1

- Rodriguez-Pose A., Crescenzi R. (2008). Mountains in a flat world: why proximity still matters for the location of economic activity. Cambridge Journal of Regions, Economy and Society, 1(3), pp.371-388. https://doi.org/10.1093/cjres/rsn011

- Rogerson P. (2001). Statistical methods for geography. London, Sage. https://doi.org/10.4135/9781849209953

- Schneider F., Frey B. S. (1985). Economic and political determinants of foreign direct investment. World Development, 13(2), pp.161-175. https://doi.org/10.1016/0305-750X(85)90002-6

- Scitowsky T. (1954). Two concepts of external economies. Journal of Political Economy, 62, pp.143-151. https://doi.org/10.1086/257498

- Topaloglou L., Kallioras D., Manetos P., Petrakos G. (2005). A border regions typology in the enlarged European Union. Journal of Borderlands Studies, 20(2), pp.67-89. https://doi.org/10.1080/08865655.2005.9695644

- UNCTAD (2007). World Investment Report, 2007: Transnational corporations, extractive industries, and development. Washington D.C., UN.

- Venables A. J. (1996). Equilibrium locations of vertically linked industries. International Economic Review, 37(2), 341-359. https://doi.org/10.2307/2527327

- Wacker K. M. (2013). On the measurement of Foreign Direct Investment and its relationship to activities of multinational corporations, ECB Working Paper Series, 1614. https://doi.org/10.2139/ssrn.2354249

- White C. M. & Fan M. (2006). Risk and Foreign Direct Investment. New York, Palgrave Macmillan. https://doi.org/10.1057/9780230624832

- Wieland, T. (2022). Spatial Patterns of Excess Mortality in the First Year of the COVID19 Pandemic in Germany. European Journal of Geography 13 (4), pp.018-033. https://doi.org/10.48088/ejg.t.wie.13.4.018.033