The R-G Differential: A Policy Instrument for German Federal States to Explore Fiscal Policy Potentials?

Published 2025-10-24

Keywords

- Fiscal Policy,

- Sustainable Debt,

- Stability Council,

- Primary Balances,

- Domar-Model

- German Federalism ...More

How to Cite

Copyright (c) 2025 Christopher Meyer, Hans-Eggert Reimers, Laima Gerlitz

This work is licensed under a Creative Commons Attribution 4.0 International License.

Accepted 2025-10-18

Published 2025-10-24

Abstract

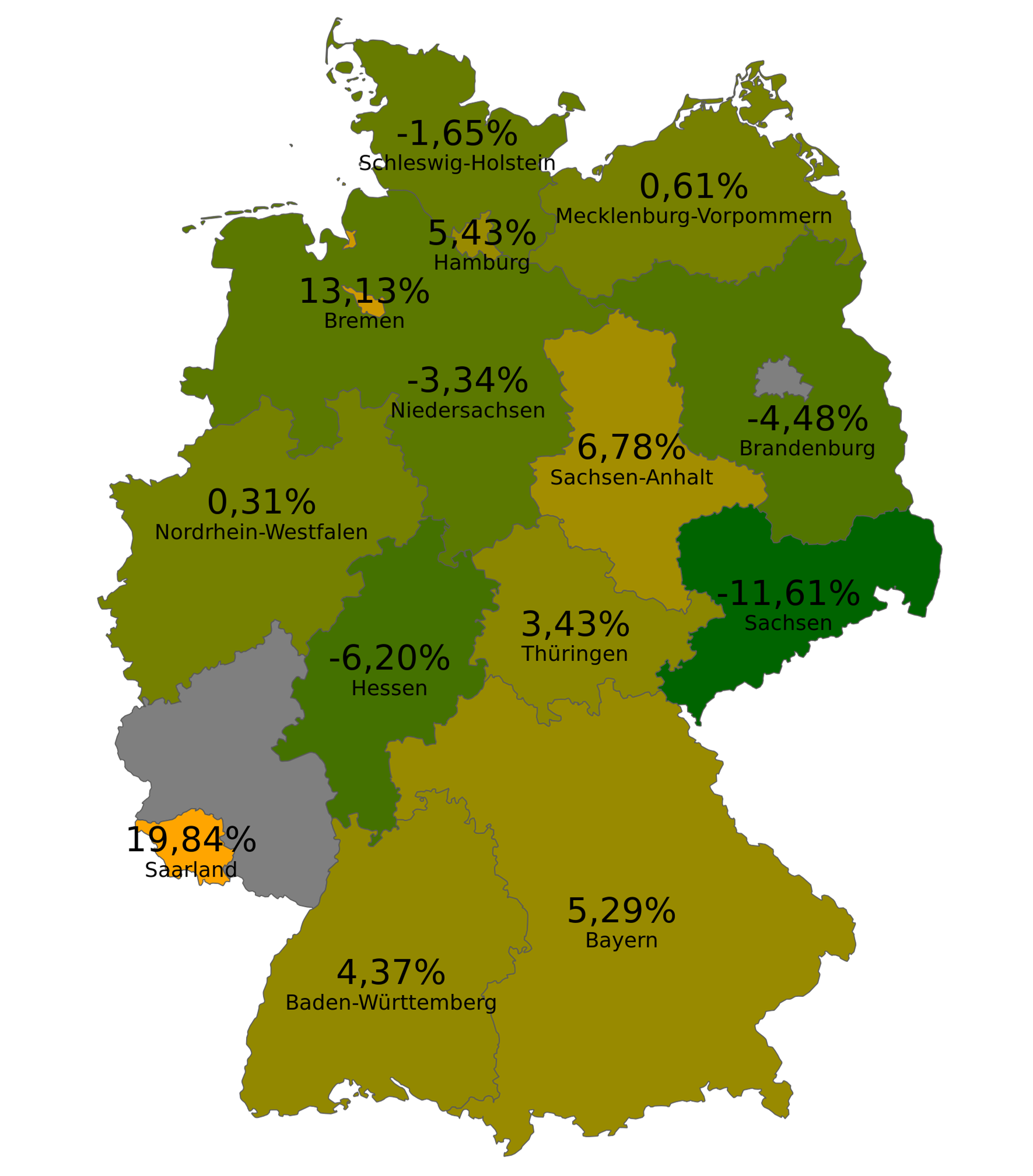

This paper examines the role of the R–G Differential—the gap between interest rates (R) and economic growth (G)—as a fiscal policy instrument for Germany’s Federal States. While widely studied at the national level, its implications for subnational fiscal sustainability remain underexplored. Building on Domar’s debt dynamics framework, the study calculates state-level R–G Differentials using official budget data from 2013–2023 and classifies states into three distinct fiscal groups. Results show that most Federal States (Länder) experienced periods of r < g, indicating favourable conditions for debt sustainability, yet this potential has not been systematically integrated into fiscal planning. The findings suggest that the R–G Differential could serve as a complementary benchmark to existing fiscal rules, enhancing medium-term planning and resilience under the constraints of Germany’s debt brake and EU fiscal framework. The paper concludes that incorporating R–G monitoring into Federal State-level reporting would not only improve transparency and comparability but also support a more nuanced, forward-looking approach to fiscal policy.

Highlights:

- Demonstrates that favourable R–G conditions allow higher expenditures, including for growth-oriented policies, without necessarily conflicting with debt brakes or fiscal sustainability.

- Positions the R–G Differential as a practical monitoring tool, offering early warnings on the sustainability of fiscal paths and the justification for debt-financed investments.

- Highlights the value of embedding rolling R–G projections into annual budgets to anticipate fiscal pressures and seize policy opportunities.

- Proposes forecast-based integration of r and g estimates into ex-ante budget planning, enabling a probabilistic and adaptive fiscal framework towards sustainable public households.

Downloads

References

- Adams, W.M. (2006). The Future of Sustainability: Re-thinking Environment and Development in the Twenty-first Century. Report of the IUCN Renowned Thinkers Meeting, 29–31 January 2006.

- Arestis, P. (2022). Macro-Economic and Financial Policies for Sustainability and Resilience. Economic Policies for Sustainability and Resilience, 1-44. https://doi.org/10.1007/978-3-030-84288-8_1.

- Bartlett, L. & Vavrus, F. (2017). Rethinking Case Study Research: A Comparative Approach; Routledge: New York, USA. https://doi.org/10.4324/9781315674889.

- Blanchard, O. J., J.-C.Chouraqui, R. P. Hagemann und N. Sartor (1990). The Sustainability of Fiscal Policy: New Answers to an Old Question, OECD Economic Studies, 15, 7-36.

- Blanchard, O. J. und P. Weil (2001). Dynamic Efficiency, the Riskless Rate, and Debt Ponzi Games. Advances in Macroeconomics, Berkeley Elec-tronic Press (BePress), 1(2), 1-23. https://doi.org/ 10.2202/1534-6013.1031.

- Blanchard, O. J. (2023), Fiscal Policy under Low Interest Rates, Cambridge University Press. https://doi.org/10.7551/mitpress/14858.001.0001.

- BMF – Bundesministerium der Finanzen (2020). Fünfter Tragfähigkeitsbericht.

- Borrego, M., Douglas, E. & Amelink, C. (2007). Quantitative, qualitative, and mixed-research methods in engineering education. J. Eng. Educ., 98, 53–66. https://doi.org/10.1002/j.2168-9830.2009.tb01005.x.

- Bryman, A., Becker, S. and Sempik, J. (2008). Quality criteria for quantitative, qualitative and mixed methods research: A view from social poli-cy. International journal of social research methodology, 11(4), 261-276. https://doi.org/10.1080/13645570701401644.

- Buettner, T. (2022a). Releasing the Brake: Germany’s National Fiscal Rule No Longer Ensures Compliance with European Fiscal Rules. The Econo-mists’ Voice, 19(1), 97-101. https://doi.org/10.1515/ev-2022-0009.

- Büttner, T. (2022b). Debt Brake or Breach of the Rules? Building Budget Reserves in Times of Crisis. Wirtschaftsdienst, 102(1), 23-26. https://doi.org/10.1007/s10273-022-3089-4.

- BVerfG – Bundesverfassungsgericht (2023). Urteil des Zweiten Senats vom 15. November 2023 - 2 BvF 1/22 -, Rn. 1-231.

- Councild of the European Union (2023). Proposal for a Council Regulation amending Regulation (EC) No 1467/97 on speeding up and clarifying the implementation of the excessive deficit procedure – Agreement in principle with a view to the consulting Parliament. Institutional File: 2023/0137(CNS), Brussels, 20 December 2023.

- Deutscher Bundestag (2025). Beschlussempfehlung und Bericht des Haushaltsausschusses (8. Ausschuss). Drucksache 20/15117.

- Deutscher Stabilitätsrat. (2024). Bericht zur Haushaltslage der Länder. Berlin: Deutscher Stabilitätsrat.

- Di Serio, M., Fragetta, M., & Melina, G. (2021). The impact of rg on Euro-Area government spending multipliers. Journal of International Money and Finance, 119, 102493. https://doi.org/10.1016/j.jimonfin.2021.102493.

- Domar, E. D. (1944). The Burden of the Debt and the National Income. The American Economic Review, 34(4), S. 798-827.

- Escolano, J. (2010). A Practical Guide to Public Debt Dynamics, Fiscal Sustainability, and Cyclical Adjustment of Budgetary Aggregates. Technical Notes and Manuals, International Monetary Fund.

- European Commission (2021): European Commission: Debt Sustainability Monitor 2020. Institutional Paper 143. Brussels.

- European Commission (2022). “r-g” differentials: latest developments and implications for public debt sustainability. Fiscal Sustainability Report 2021, Institutional Paper 171, April, 164-180.

- European Commission. (2024). Communication on the reform of the EU economic governance framework. Brussels: European Commission.

- Feld, L. P., & Reuter, W. H. (2022). The German “Debt Brake”. Public Debt Sustainability: International Perspectives, 117.

- Fenge, R. (2021). Warum eine Schuldenbremse sinnvoll ist. ifo Schnelldienst, 74(9), 70-72.

- Feld, L. P., & Reuter, W. H. (2022). Debt brakes in the European Union: Relevance, problems and reform options. Eurasian Economic Review, 12(1), 1–29. https://doi.org/10.1007/s40822-021-00184-5.

- Heimberger, P. (2023). Public debt and rg risks in advanced economies: Eurozone versus stand-alone. Journal of International Money and Finance, 136, 102877. https://doi.org/10.1016/j.jimonfin.2023.102877.

- Herndon, T., Ash, M., & Pollin, R. (2014). Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff. Cam-bridge journal of economics, 38(2), 257-279. https://doi.org/10.1093/cje/bet075.

- Kaur, A., Kumar, V., Sindhwani, R., Singh, P. L., & Behl, A. (2022). Public debt sustainability: a bibliometric co-citation visualization analysis. Inter-national Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-04-2022-0724.

- Korioth, S., & Wernsmann, R. (2012). Föderalismusreform II und Schuldenbremse. Festschrift 60 Jahre Grundgesetz (S. 421–445). Tübingen: Mohr Siebeck.

- Korioth, S. (2016). A path to balanced budgets of Bund and Länder? The new shape of the ‘debt brake’and the ‘stability council’. Regional & Federal Studies, 26(5), 687-705. https://doi.org/10.1080/13597566.2016.1214130.

- Larch, M., Malzubris, J., & Santacroce, S. (2023). Numerical compliance with EU fiscal rules: Facts and figures from a new database. Intereconom-ics, 2023(1), 32-42. https://doi.org/10.2478/ie-2023-0008.

- Larch, M., Orseau, E., & van der Wielen, W. (2023). Debt sustainability assessments: The r–g approach and beyond. Luxembourg: Publications Office of the European Union.

- Pedrosa, Í., Brochier, L., & Freitas, F. (2023). Debt hierarchy: autonomous demand composition, growth and indebtedness in a supermultiplier model. Economic Modelling, 126, 106369. https://doi.org/10.1016/j.econmod.2023.106369.

- Priewe, J. (2022). Die europäischen Fiskalregeln und die deutsche Schuldenbremse: Reformoptionen. Friedrich-Ebert-Stiftung.

- Priewe, J. (2023). Schuldentragfähigkeit mit impliziten Staatsschulden–Leitbild oder Irrlicht?. Wirtschaftsdienst, 103(3), 198-204. https://doi.org/10.2478/wd-2023-0053.

- Schmidt, C. M. (2020). The German Debt Brake on Trial: Not Guilty. CESifo Forum, ifo Institut–Leibniz-Institut für Wirtschaftsforschung an der Universität München, 21(1), 33.40.

- Ragnitz, J., & Röhl, K.-H. (2021). Ungleichheit der regionalen Wirtschaftsentwicklung in Deutschland. Wirtschaftsdienst, 101(5), 355–362. https://doi.org/10.1007/s10273-021-2890-4.

- Schuster, F., Krahé, M., Sigl-Glöckner, P., & Leusder, D. (2021). The cyclical component of the debt brake: analysis and a reform proposal.

- Shields, P.M. & Rangarajan, N. (2013). A Playbook for Research Methods: Integrating Conceptual Frameworks and Project Management; New Forums Press: Stillwater, OK, USA.

- Waldhoff, C. (2024). The Debt Brake as a Means of Intertemporally Safeguarding Freedom: On the Ruling of the German Federal Constitutional Court on the Second Supplementary Budget Act 2021 (Zweites Nachtragshaushaltsgesetz 2021). European Constitutional Law Review, 1-14. https://doi.org/10.1017/S1574019624000221.

- Werding, M., Gründler, K., Läpple, B., Lehmann, R., Mosler, M., & Potrafke, N. (2020). Modellrechnungen für den Fünften Tragfähigkeitsbericht des BMF. Studie im Auftrag des Bundesministeriums der Finanzen, ifo Studie.

- Yazan, B. (2015). Three approaches to case study methods in education: Yin, Merriam, and Stake. Qual. Rep., 20, 134–152. https://doi.org/10.46743/2160-3715/2015.2102.

- Yin, R.K. (2018). Case Study Research and Applications; Sage: Thousand Oaks, CA, USA.

- Zettelmeyer, J. (2025). Can Germany afford to take most defence spending out of its debt brake?.

- Zipfel, F., Böttcher, B., & Mayer, T. (2011). Stability Council: Financial inspector of Germany’s Länder. Economics & Politics Research Briefing.